japan corporate tax rate 2017

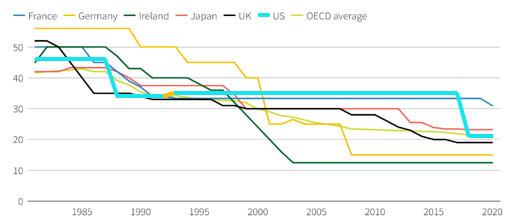

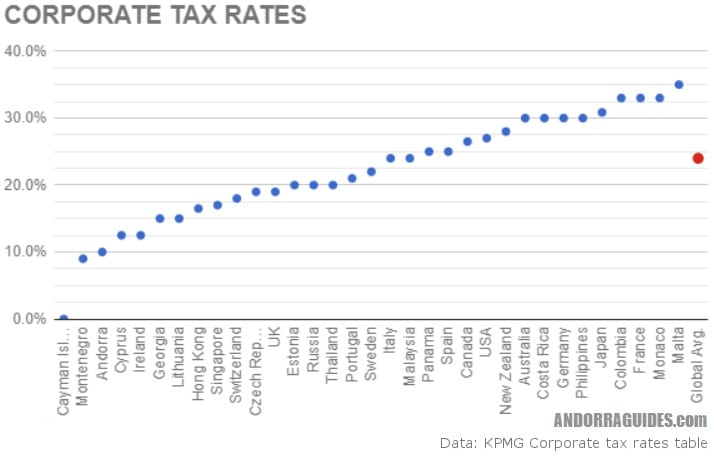

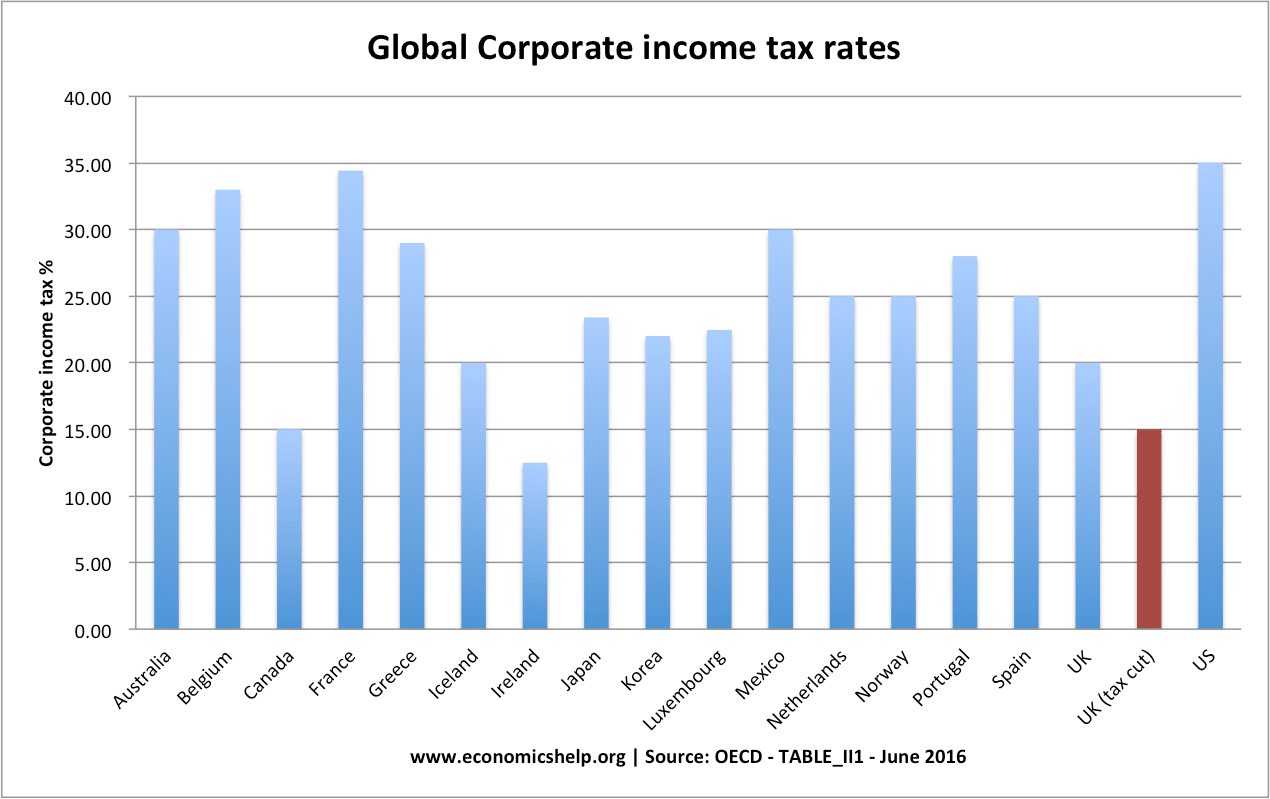

4890 Dec 31 2015. OECD member states have an average statutory corporate tax rate of 2418 percent and a rate of 3112 when weighted by GDP.

How Do Taxes Affect Income Inequality Tax Policy Center

World Bank Japan Japan Corporate Tax Rate.

. The corporate tax rate in Japan for a branch is the same as for a subsidiary. Effective Corporate Tax Rates With Uniform and Country-Specific Rates of Inflation in G20 Countries 2012 37 Figure B-4. 5040 Dec 31 2013.

The G7 which is comprised of the seven wealthiest nations in the world has an average statutory corporate income tax rate of 2957 percent and a weighted average rate of 3348 percent. 115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate and repealed the corporate alternative minimum tax AMT effective for tax years beginning after December 31 2017. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident.

The tax is charged at a rate of 07 of the capital increase with a minimum tax of JPY 150000 for the incorporation of a KK. The government initially planned to reduce the rate to below 30 percent in fiscal 2017 after cutting it to 3133 percent in fiscal 2016. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

A Look at the Markets. Tax year beginning between 1 Apr 201631 Mar 2017. The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387.

Corporation tax is payable at 239 percent. 4880 Japan Corporate tax rate. A tax reform bill will be prepared based on the outline and is expected to be enacted by.

Local corporation tax applies at 44 percent on the corporation tax payable. Our company registration advisors in Japan can deliver more details related to the corporate tax in this country. Bank commissions and legal fees may vary depending on the size of the company.

Tax rates for companies with stated capital of JPY 100 million or greater are as follows. The special local corporate tax rate is 4142 and is imposed on taxable income multiplied by the. But if the company is Medium and small sized company the taxable income limitation does not apply.

Equity Bulls Jittery Dollar Sinks as Investors Digest Inflation Data. The corporation tax is imposed on taxable income of a company at the following tax rates. Local management is not required.

Current Japan Corporate Tax Rate. At present Japans corporate tax rate is 3211 percent. Tax year beginning after 1 Apr 2018.

Japan Corporate Tax Rate for Dec 2017. Types of sharesAll types of shares may be issued. Japan Corporate Tax Rate History.

Effective Corporate Tax Rates With Alternative Allocations of Asset Shares in G20 Countries 2012 34 Figure B-2. Tax rates for fiscal year filers. On the corporate side Japan recently passed the 2016 Tax Reform Act reducing the combined national and local corporate tax rate from 3211 percent in fiscal year 2015 to 2997 percent in fiscal years 2016 and 2017 with an eventual reduction to 2974 percent in.

Limitation ratio for large corporations. 1 If a company has capital in excess of 100 million Japanese yen or is a wholly owned subsidiary of a large corporation with capital of more than 500 million Japanese yen the company is treated as large corporation under corporate tax. However under section 15 corporations with fiscal tax years beginning before January 1 2018 and.

332 Corporate income taxes and tax rates The taxes levied in Japan on income generated by the activities of a corporation include corporate tax. 55 of taxable income. Tax year beginning between 1 Apr 201731 Mar 2018.

Tax base Small and medium- sized companies 1 Other than small and medium-sized companies Taxable income up to JPY8 million in a year 19 15 2 234 3 Taxable income in excess of JPY8 million 234 3. Tax year 2015 1 Tax year 2016. 60 of taxable income.

Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits. Dec 31 2017. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019.

Reform to Japan corporate income tax tax incentives directors compensation and similar rules to increase the competitiveness of Japanese business globally. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies. 50 of taxable income.

Business tax comprises of regular business tax special local corporate tax and size-based business tax. 4740 Dec 31 2016. Effective Corporate Tax Rates With Alternative Rates of Inflation in G20 Countries 2012 35 Figure B-3.

5040 Dec 31 2014. 50 2 Carryover period for loss utilisation as well as assessment by tax authorities and request for downward adjustment by taxpayer assuming loss period financial documentation is maintained 9 years. The regular business tax rates vary between 03 and 14 depending on the tax base taxable income and the location of the taxpayer.

Japan approved new carrot-and-stick tax measures to bring corporate taxes down to 25 for companies that raise wages by 3 and to as low as 20 for those that invest in new technologies communications and internet-of-things for example on Thursday.

Inequality And Taxes Inequality Org

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Global Corporate And Withholding Tax Rates Tax Deloitte

The Andorra Tax System Andorra Guides

International Corporate Tax Reform Dgap

Does Cutting Corporate Tax Rates Increase Revenue Economics Help

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Trump Tax Plan Halts Inversions But Increases Treaty Shopping Vox Cepr Policy Portal

How Do Taxes Affect Income Inequality Tax Policy Center

Doing Business In The United States Federal Tax Issues Pwc

Global Corporate And Withholding Tax Rates Tax Deloitte

Part V World Inequality Report 2018

Corporate Tax Reform In The Wake Of The Pandemic Itep

Corporation Tax Europe 2021 Statista

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times